Resources for Businesses

Have questions or an idea about how we can help your business? Let us know!

|

Local Support and Assistance

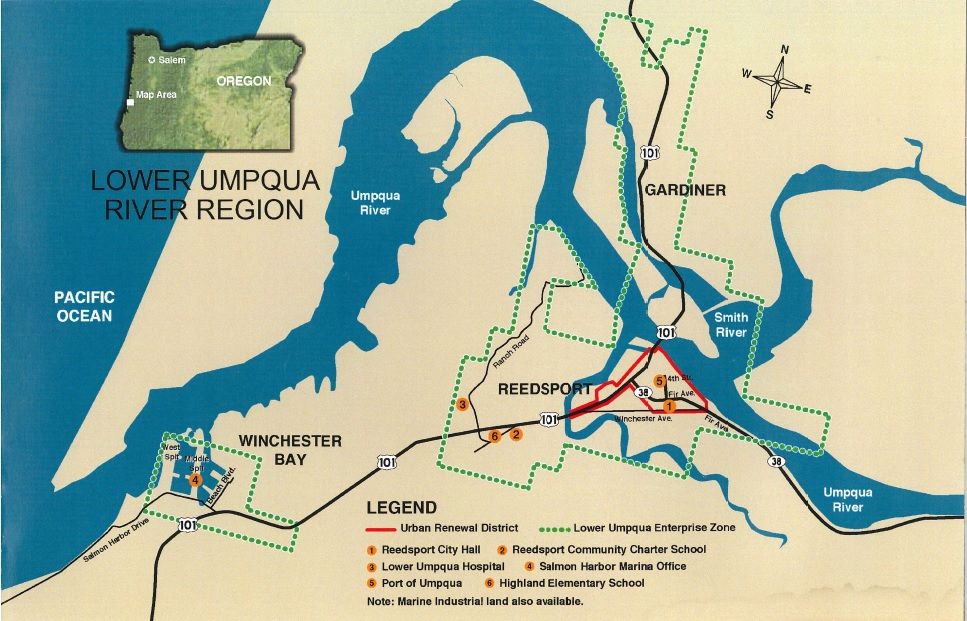

Partnership for Economic Development in Douglas County - Provides resources for new and existing businesses, including information on the Lower Umpqua Enterprise Zone, which offers abatement from property taxes in the Reedsport area. SWOCC Small Business Development Center (SBDC) - Provides practical information and services for business success. Offering training, advice, and technical support. Local classes and workshops available at SWOCC in North Bend, but advisors will also travel to Reedsport to work with business owners in person. CCD Business Development Corporation - Provides technical assistance, project development, grant/project application writing and grant/project administration for business in Coos, Curry, and Douglas Counties. South Coast Development Council - A non-profit organization that exists for the purpose of fostering communication, collaboration and partnership among the various collateral public and private entities on Oregon’s South Coast; and promoting economic development, job creation, business retention and expansion, encouraging new investment, and enhancing the economic vitality of the region. Neighborworks Umpqua - Education, training, networking, marketing, and assistance to start or expand a small or independent business in Coos, Curry, and Douglas Counties. Community LendingWorks - Provides access to capital for start-up and microenterprise businesses. Focuses on micro-loans ranging from $300-$50,000. In addition, they offer technical assistance to prepare business plans, including marketing, financial projections, and general business support. CLW offers responsible, flexible lending to businesses in Douglas County. Business Oregon - Oregon's Official State Economic Development Agency, helping connect Oregon businesses to the resources they need to grow and improve. Help with Social Media

RMSP Guide to Social Media (PDF) - An introduction to different social platforms and how to use them. The Best and Worst Times to Post to Social Media - by SocialPilot Essential Facebook Marketing Resources: A Complete Guide - by SocialMedia Examiner Engaging Your Audience by Publishing to Your Page (PDF) - by Facebook Six Posts that Build Engagement on Facebook - by Mashable How to Make Facebook Work for You (PDF) - by Facebook A Guide to Visual Storytelling (PDF) - by ResourceMedia |

Reedsport-specific Information

Opening a business in Reedsport - Advice from the Reedsport/ Winchester Bay Chamber of Commerce

Grants and Other Funding RMSP Business Improvement Grant - Our own grant, available to Reedsport businesses along Hwys 101 and 38. Up to $2,500 in matching funds. Rural Energy for America Program Renewable Energy Systems & Energy Efficiency Improvement Loans & Grants - Awards up to $20,000. Funds may be used for the purchase, installation and construction of renewable energy systems. FedX Small Business Grant - Awards up to $25,000 every year to ten small businesses. Applications open in May. IdeaCafe's Small Business Grant - $1,000 for a small business with the most innovative idea. Free registration is required. Business USA - A search engine for business grants and loan assistance. Enter Reedsport's ZIP code, check the box marked "rural community," and fill in other details specific to your business. |